AI stock prediction and analysis platforms should be compatible and seamlessly integrate with existing tools, systems, and workflows. Integrating your platform into the existing tools, systems, and workflows is a excellent way to improve efficiency. Here are our top 10 recommendations for assessing the compatibility and integration of these platforms.

1. Check Brokerage Integration

Make sure that your platform is integrated seamlessly with the trading or brokerage service you want.

Trade execution: Determine whether the platform allows direct trade execution through the broker integrated.

Account Synchronization: Ensure that the platform has the ability to sync real-time balances of your account along with positions and transaction histories.

2. Assess the availability of APIs

API access: Verify that the platform has an API that developers can use if they would like to automate workflows, or build customized tools.

API documentation: Ensure that the API is documented well with use-cases and examples.

Limitations on rate. Check that the API you're considering has reasonable limits on rate and can handle your usage volume.

3. Examine Third-Party Integration

Popular tools: Check whether the platform works with tools like Excel, Google Sheets, or trading bots.

Export and import of data: Ensure that the platform supports easy export and import of data to and from other tools.

Extensions/Plugins: Verify whether the platform is compatible with extensions or plugins for additional functionality.

4. Test Compatibility Operating Systems

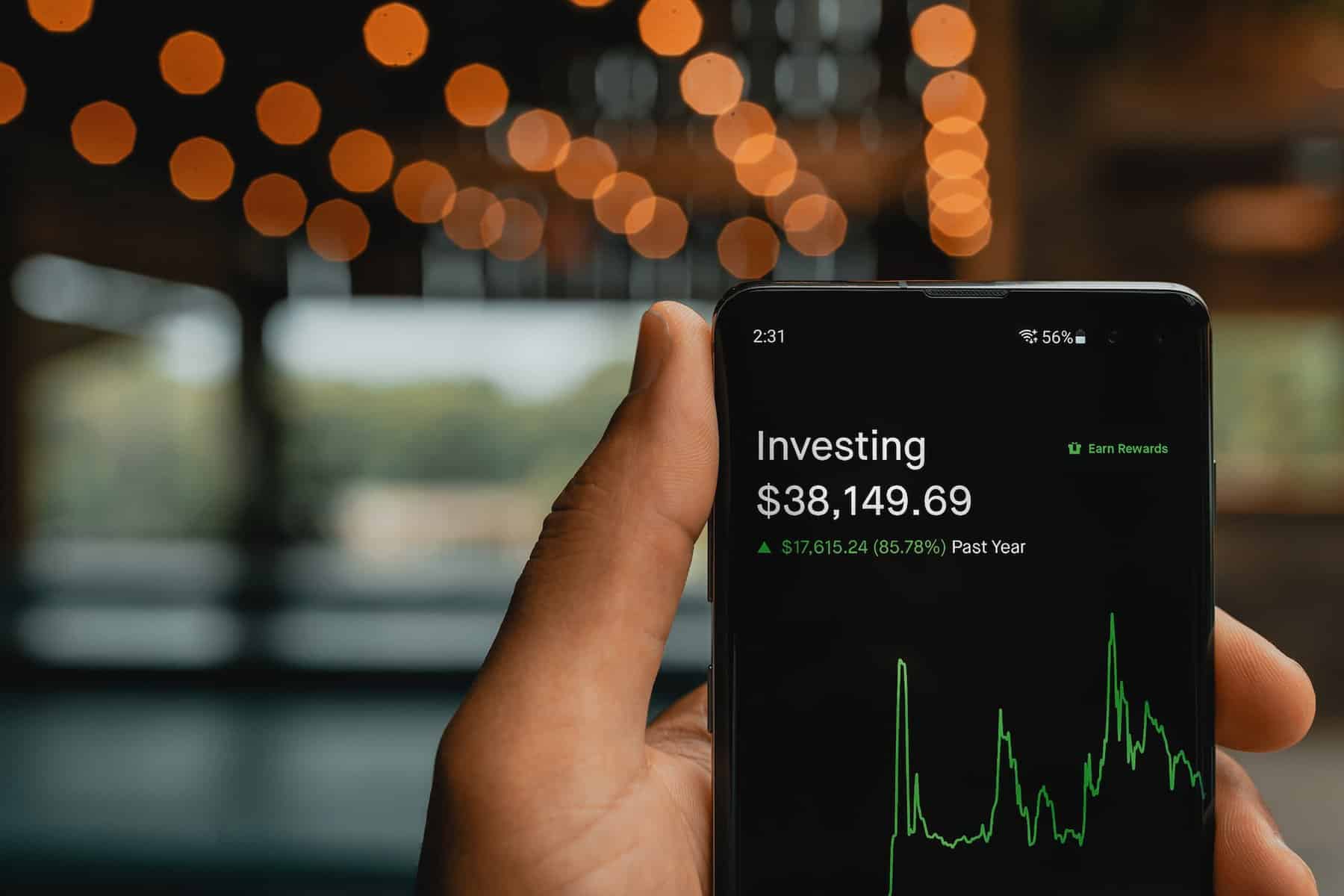

Desktop compatibility: Ensure the application works with the operating system you prefer (Windows, macOS, Linux).

Mobile compatibility: See whether the platform provides mobile apps for iOS as well as Android.

Access via the internet (for greater flexibility) Check that the platform is accessible via the web browser.

5. Assessment of the Data Integration Capabilities

Data sources: Ensure that the platform integrates with multiple data resources (e.g. market data sources or news feeds).

Real-time data feeds: Check whether the platform allows real-time data integration to provide the most current analysis.

Check to see if your platform supports the import of historical data to analyze or backtest.

6. Check cloud and on-premise compatibility

Cloud-based platform that is accessible any time, anywhere, as long as you have an Internet connection.

On-premise solutions: If you prefer on-premise deployment, confirm that the platform you are using supports it.

Hybrid solutions: See whether the platform has an hybrid model that combines cloud and on-premise capabilities.

7. Make sure to check for Cross Platform Synchronization

Device synchronization. Ensure data and settings are synced across all platforms (desktops tablets and mobiles).

Check if changes made to a device are instantly reflected on another.

Examine the platform to determine whether it allows access to data or functions when you're offline.

8. Assess the Compatibility of Trading Strategies

Algorithmic Trading: Check that the platform is compatible with algorithmic or automated trading strategies.

Custom indicators. Check whether the platform allows you to utilize technical indicators or scripts.

Strategy backtesting. Check whether the platform supports strategies that are tested back using historical data.

9. Assess Security and Compliance

Data encryption - Make sure that your platform uses encryption for all data at all times, including when it is in rest.

Authentication : Verify that the platform is compatible with safe authentication methods (e.g. 2-factor authentication).

Regulatory compliance - Check if your platform is compliant with applicable laws, e.g. GDPR. FINRA. SEC.

10. Test Scalability, Performance and Efficiency

Scalability: Ensure the platform is able to handle the increasing amount of data and users as the demands of your business increase.

Performance under load: Check whether the platform responds under high-volatility conditions.

Utilization of resources: Determine whether the system is efficient in using the resources of the system (CPU memory, bandwidth, CPU).

Bonus Tips

Users' feedback: Look for reviews and comments from users when you are evaluating the site.

Trial period: Make use of a no-cost trial or demo to test how the platform works with other software and processes.

Customer Support: The platform must provide solid support when it comes to integration problems.

Use these guidelines to evaluate the compatibility and integration between AI stock predicting/analyzing platforms and your existing trading systems, and ensure they enhance your trading effectiveness. View the top learn more here about ai investment bot for more examples including learn stock market trading, investing ai, artificial intelligence stock picks, stock websites, artificial intelligence stock picks, learn stocks, ai investment bot, learn stocks, learn stock market, stock prediction website and more.

Top 10 Tips To Assess The Updates And Maintenance Of Ai Stock Trading Platforms

It is important to assess the maintenance and updates of AI-driven trading and stock prediction platforms. This will ensure that they're secure and up-to-date with evolving market conditions. Here are 10 tips for evaluating their updating and maintenance procedures.

1. Updates are made regularly

Check the frequency of updates on your platform (e.g. monthly, weekly, or quarterly).

The reason: A regular update shows an active and rapid development as well as the ability to respond to market changes.

2. Transparency in Release Notes

Check out the release notes for your platform in order to find out what improvements and changes were made.

Transparent release notes show the platform's dedication to continual improvement.

3. AI Model Retraining Schedule

Tip Ask how often AI is retrained with new data.

Since markets are constantly changing It is crucial to keep up-to-date models to remain current and relevant.

4. Bug Fixes & Issue Resolution

Tip - Assess the speed with which the platform resolves technical and bug issues.

Why: Quick bug fixes help ensure the system's stability and function.

5. Updates to Security

Tip : Verify whether the platform regularly updates its security protocol to secure user data.

The reason: Cybersecurity plays a critical role in financial platforms. It aids in safeguarding against fraud and breaches.

6. Integration of New Features

Tips: Find out whether the platform has introduced new functions (e.g., advanced analytics, new sources of data) Based on feedback from users or market trend.

Why: Features updates demonstrate creativity, responsiveness to user needs and new ideas.

7. Backward Compatibility

Tips: Make sure that the update does not cause significant interruptions to functionality that is already in place or require significant reconfiguration.

The reason is that backward compatibility offers a smooth experience for users through transitions.

8. Communication between Users and Maintenance Workers

It is possible to evaluate the transmission of maintenance schedules and downtimes to users.

What is the reason? Clear communication prevents interruptions and increases trust.

9. Performance Monitoring and Optimization

Tip - Check that the platform is constantly monitoring metrics of performance (e.g. accuracy, latency) and optimizes systems.

Why: Ongoing platform optimization ensures that it stays functional and expandable.

10. Compliance with Regulatory Changes

Verify if the platform changed its policies and features in order to comply with any recent data legislation or regulations regarding financial transactions.

The reason: To minimize legal risk and maintain user's trust, compliance with regulations is essential.

Bonus Tip: User Feedback Integration

Verify that maintenance and updates are based on user feedback. This demonstrates a user centric approach and a commitment towards improvement.

Through analyzing these elements by evaluating these factors, you can ensure that the AI-based stock prediction and trading platforms that you select are maintained, up-to-date and able to adjust to market conditions that change. Take a look at the recommended her explanation on best stock prediction website for site advice including stock predictor, ai share trading, best stock prediction website, chart analysis ai, chart analysis ai, free ai tool for stock market india, stocks ai, ai options trading, chart ai trading, best ai for stock trading and more.